DS-1504 2017-2024 free printable template

Show details

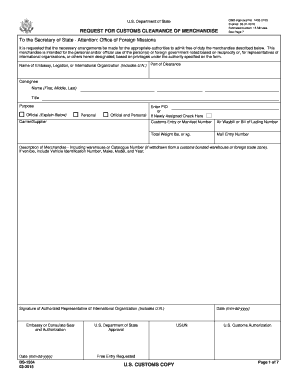

N. Embassy or Consulate Seal and Authorization Date mm-dd-yyyy DS-1504 05-2017 Approval USUN U.S. Customs Authorization Free Entry Requested U.S. CUSTOMS COPY Page 1 of 7 APPROVED COPY OFM COPY CUSTOMER COPY Convention on7 Consular Relations PRIVACY ACT STATEMENT AUTHORITIES The information is REQUEST sought pursuant to Vienna on Diplomatic Relations of 1961 Vienna FOR CUSTOMS CLEARANCE OF MERCHANDISE of 1963 Diplomatic Relations Act 22 U.S.C. U*S* Department of State REQUEST FOR CUSTOMS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ds 1504 2017-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ds 1504 2017-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ds 1504 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form customs clearance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

DS-1504 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ds 1504 2017-2024 form

To fill out the form customs clearance, follow these steps:

01

Gather all necessary information and documents such as the invoice, bill of lading, packing list, and any other relevant paperwork.

02

Identify the type of goods being imported or exported, their value, and the country of origin/destination.

03

Fill in the details accurately and completely, including the names and addresses of the exporter and importer, the description of the goods, quantity, weight, and unit prices.

04

Provide the HS (Harmonized System) code for the goods, which is a standardized international system of names and numbers used to classify products for customs purposes.

05

Calculate the total value of the goods and any applicable duties, taxes, or fees. Be sure to include any applicable exemptions or special considerations.

06

Sign and date the form customs clearance, and make a copy for your records.

07

Submit the completed form customs clearance to the appropriate customs authority or your customs broker.

Who needs form customs clearance?

Form customs clearance is typically required by individuals or businesses involved in international trade, specifically importing or exporting goods across borders. It is necessary to comply with customs regulations and to facilitate the smooth movement of goods through customs checkpoints. Importers, exporters, manufacturers, distributors, and freight forwarders are among the key parties who need to fill out form customs clearance. The specific requirements may vary depending on the country and the type of goods being imported or exported.

Video instructions and help with filling out and completing ds 1504

Instructions and Help about form ds 1504

Fill ds 1504 form : Try Risk Free

People Also Ask about ds 1504

What is the purpose of customs clearance?

What is customs clearance document?

How do I get a customs clearance certificate?

What are the stages of custom clearance?

What is the customs clearance process complete?

What is the process of customs clearance?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form customs clearance?

Customs clearance is the process of overcoming the legal formalities and requirements needed to allow goods to enter or exit a country. It involves submitting specific documents, forms, and declarations to the customs authorities, who then inspect and verify the goods to ensure compliance with import or export regulations, customs duties, and tax obligations.

"Form customs clearance" may refer to the specific form or document required for this process. It typically includes details such as the description of goods, their quantity, value, origin, country of destination, and other relevant information. The form is completed by the importer or exporter and submitted to the customs authorities for review and approval.

Who is required to file form customs clearance?

Form customs clearance is typically required to be filed by importers or their representatives.

How to fill out form customs clearance?

Filling out a customs clearance form can vary depending on the specific form and country you are dealing with. However, here are some general steps to help you understand the process:

1. Obtain the form: Ensure you have the correct customs clearance form for the country you are importing or exporting goods to/from. You can usually find these forms on the customs authority's website or by contacting them directly.

2. Gather necessary information: Collect all the required information to complete the form. This typically includes your contact details, shipment details, description of goods, quantity, value, and any additional documentation such as invoices, packing lists, or licenses.

3. Identify the type of shipment: Determine the type of shipment you are clearing customs for, whether it is for personal use, commercial purposes, or as a gift. Different forms may be applicable based on the type of shipment.

4. Declare the goods: Clearly describe the items being shipped. Include details such as the name, quantity, weight, value, and purpose of each item. You may need to use specific codes or classifications for certain goods.

5. Calculate the customs duties and taxes: Determine the customs duties and taxes applicable to your shipment. This will be based on the value and type of goods you are importing or exporting. Some countries provide online tools or calculators to help you estimate these costs.

6. Provide additional documentation: Attach any supporting documentation required by customs, such as invoices, packing lists, certificates of origin, or permits. Ensure these documents are accurate and complete.

7. Sign and submit the form: Review the completed form for any errors or omissions. Sign and date the form as required. Submit the form along with any supporting documentation to the relevant customs authority. This can usually be done electronically or in person at the designated customs office or port.

8. Pay customs duties and taxes: If applicable, pay the customs duties and taxes as determined by customs. Payment can often be made online, at a customs office, or through a designated bank.

9. Follow customs procedures: After submitting the form and paying any necessary fees, carefully follow any additional procedures outlined by customs. This may involve inspections, verification processes, or obtaining release or clearance documents.

Note that customs clearance processes can be complex and differ from one country to another. It's advisable to seek guidance from a customs broker or consult the specific customs authority's website for detailed instructions and requirements.

What is the purpose of form customs clearance?

The purpose of customs clearance is to closely examine and assess goods that are being imported or exported into a country. The customs clearance process ensures that the proper duties, taxes, and tariffs are paid, and that the goods comply with all legal and regulatory requirements of the country. It also helps in preventing smuggling, illegal trade, and the entry of restricted or prohibited goods into a country. Customs clearance forms are used to provide detailed information about the goods being imported or exported, thus facilitating the smooth and lawful movement of goods across international borders.

What is the penalty for the late filing of form customs clearance?

The penalty for the late filing of form customs clearance can vary depending on the country and specific circumstances. Generally, late filing can result in fines or penalties imposed by the customs authorities. The amount of the penalty could be a fixed amount or calculated based on a percentage of the value of the goods being imported or exported. It is important to consult the specific regulations of the relevant customs authority or seek advice from a customs broker or legal professional to understand the exact penalties associated with late filing.

Where do I find ds 1504?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form customs clearance in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in ds1504?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your request customs clearance to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the customs requested form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 1504 in seconds.

Fill out your ds 1504 2017-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ds1504 is not the form you're looking for?Search for another form here.

Keywords relevant to customs requested pdf form

Related to s customs state

If you believe that this page should be taken down, please follow our DMCA take down process

here

.